African tech funding is accelerating again after two tough years, with investment surpassing 3 billion dollars and IPOs reopening across the continent. Strong equity flows, renewed investor confidence, and major deals in fintech, clean energy, and agritech signal a dynamic shift for Africa’s digital economy.

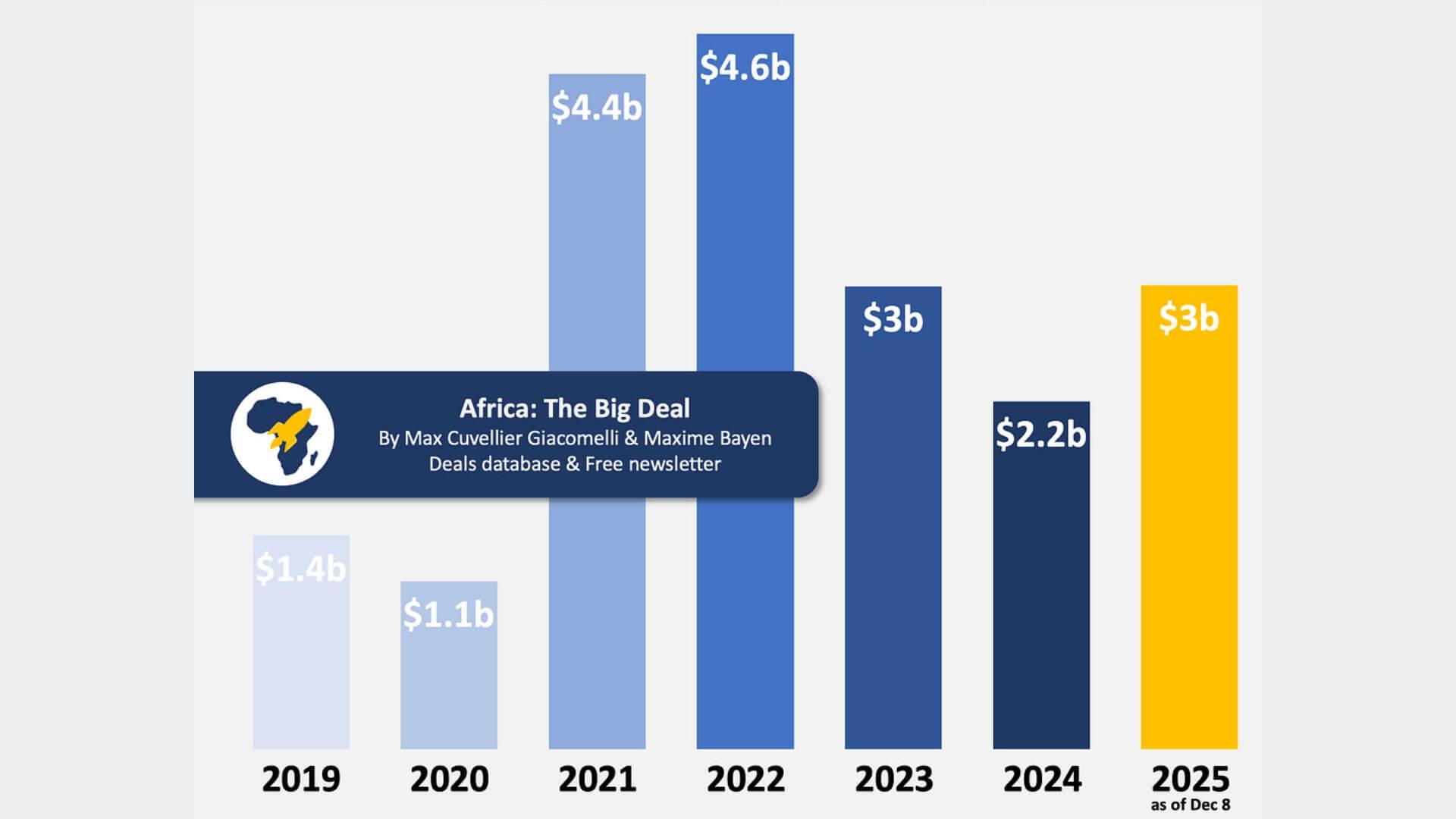

NAIROBI, KENYA — 2025-12-09 — Capital flowing into African technology companies has climbed sharply this year, with disclosed investment rising by roughly one-third compared with 2024, according to data from Africa: The Big Deal and other market monitors. Tracker estimates show between 2.2 billion and 2.65 billion dollars committed by the end of the third quarter and October, placing 2025 on course to exceed 3 billion dollars for the first time since the ecosystem’s downturn in 2023 and 2024.

Updated 14:00 UTC.

Researchers told Business Insider Africa and other publications that the recovery reverses two years of steep declines, when rising global interest rates and currency instability dampened venture appetite. Analysts at Nanyang Technological University (NTU) said 2025 is performing far better than expected, noting that investment through September had already approached last year’s full-year tally.

Africa-focused databases tracking rounds through October reported approximately 2.65 billion dollars in funding, surpassing comparable 2023 volumes. Market watchers say the pipeline of late-year deals suggests the final number could strengthen further if pending transactions close by December.

Equity remains the primary engine of the rebound. TechCabal, NTU researchers, and additional sources report that African ventures secured about 1.42 billion dollars across 243 equity transactions in the first half of 2025, representing more than 70 percent growth year-on-year. Debt structures are also growing in relevance, especially for sectors that require long-term assets such as clean energy, logistics,s and mobility.

November’s activity reinforced the momentum. According to Africa: The Big Deal, startups secured roughly 162 million dollars across 32 companies during the month, with four out of five dollars arriving through equity. That performance positioned November among the strongest funding periods of the year and kept overall deal flow ahead of the last two annual cycles.

Among the largest rounds were 60 million dollars raised by South Africa’s SolarSaver for energy deployment and 21 million dollars secured by Tunisia’s nextProtein in agritech. Additional mid- to late-stage transactions in fintech and logistics signaled investor confidence in asset-heavy business models that underpin regional economies.

The funding revival has been accompanied by a noticeable uptick in exits. Investment platforms tracking mergers and acquisitions noted multiple transactions, including the sale of payments provider Walletdoc for roughly 23 million dollars. November also saw two landmark public listings: Optasia debuted on the Johannesburg Stock Exchange with a capital raise of about 345 million dollars, while Morocco’s Cash Plus listed in Casablanca, attracting around 82.5 million dollars.

Fintech remains the dominant category, drawing an estimated 45 percent of all funding this year. Industry figures indicate that more than 640 million dollars entered fintech in the first six months alone, with major allocations to Wave, LemFi, Stit, ch, and Egypt’s Bokra. Activity is broadening across artificial intelligence, digital identity, agritech, edtech, and clean energy, reflecting investor interest in solutions tied to infrastructure, productivity, and social outcomes.

Nigeria, Kenya, South Africa, a and Egypt continue to receive the majority of disclosed capital—researchers estimate between 78 and 84 percent in 2025—though North African and Francophone markets, ts including Morocco, Tunisia, and Senegal,l are securing larger rounds and public listings, widening the continent’s investment geography.

African investors speaking to outlets such as TechCabal and FurtherAfrica said this year’s resurgence reflects currency adjustments, improved macroeconomic signals, ls and more realistic startup valuations after the overheated cycle of 2021–2022. Several venture capital firms characterised 2025 as a “reset” that has pushed founders to prioritize governance, capital discipline, and sustainable growth.

Founders interviewed across Nigeria, Kenya, and South Africa said renewed deal activity—particularly equity paired with structured debt—has enabled them to resume regional expansion delayed during the previous downturn. Entrepreneurs in AI and digital infrastructure reported increasing interest from global investors willing to support multi-country strategies rather than isolated pilots.

Public sentiment monitored by regional business outlets suggests guarded optimism. While many observers welcomed the listing of Cash Plus as proof that domestic exchanges can support scale, concerns remain about currency volatility, regulatory clarity,y and the risk of overconcentration in a handful of markets.

The African Union and African Development Bank have reinforced the importance of digital entrepreneurship for job creation and long-term competitiveness. Officials speaking at recent innovation forums emphasized that the gains of 2025 must be accompanied by continued investment in connectivity, digital identity, data frameworks, ks and regulatory modernization.

This rebound follows two difficult years in which global risk aversion and domestic monetary pressures suppressed deal volume despite rising demand for digital services. The return of large rounds in agritech, solar energy, logistics, and e-mobility underscores a shift toward technologies that strengthen resilience, productivity, and climate adaptation.

Analysts tracking funding dashboards say that, if current momentum continues, 2025 will comfortably breach the 3 billion dollar mark. Several sizable deals nearing close in energy, mobility,y and financial services could raise the final tally further. Attention is now turning to how 2026 may unfold as African governments and regional institutions advance new policies on cross-border data flows, fintech licensing, and startup taxation.

Leave a comment

Your email address will not be published. Required fields are marked *